Understanding the Paper Check

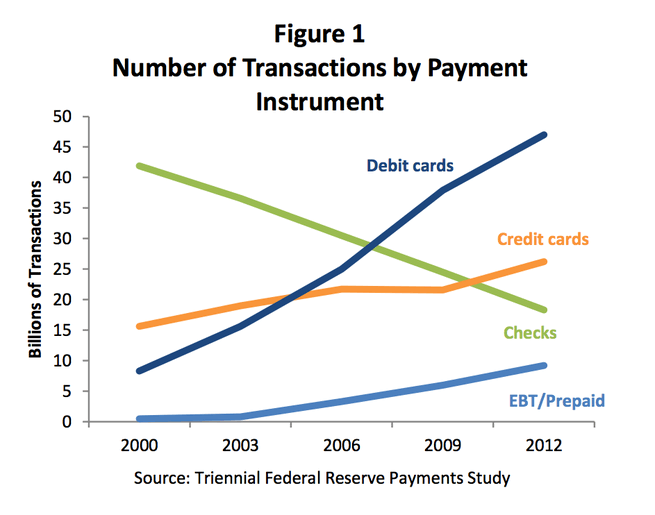

Outside of cash and precious metals, checks are the oldest form of payment. It is an economic dinosaur that America has yet to give up on. In many countries like Germany, Australia, Sweden, and Norway, the personal check is almost completely obsolete. Other countries like Poland, Finland, and the Netherlands have left it firmly in the rearview mirror. While the usage of checks in the United States has declined since the mid-1990s, 97% of businesses still accept personal check as a form of payment.

Analog payments are expensive

Current economic conditions give financial institutions little incentive to drop the check, but it does not mean that your organization still must accept it. From start to finish, a payment made by check is a multistep process that takes considerable amount of energy, time, labor, and billing to accommodate.

- Printing

- Stuffing

- Stamping

- Mailing

- Reviewing

- Logging by accountant

- Depositing

- Clearing

Normal methods of clearing checks can cost anywhere between $2-$10 per check for an organization to deposit. Funny enough, this is a static cost that doesn’t go down the more checks you process. The most important fact to note about how expensive they are is that this method of payment brings zero value to your organization. It does not enhance your branding, member experience, or engagement. It does not hold internal value with staff either. In fact, I would argue that it is inefficient and more of a headache on your administration in your non profit business than a help.

It is one of the slowest ways to get your money. According to Dow Jones, while the funds from a paper check might be available within a few days, it could take as long as nine business days for a check to clear. This can be an accounting nightmare when compared to ACH, debit, or any other form of electronic payment.

Paper checks are a security issue.

There are a host of reasons why checks are risky for both parties. Checks are easily forged and replicated. All it takes is one individual with bad intentions and a signed check. With little effort and fundamental photoshop knowledge, anyone can duplicate your check and personal information in a few minutes. This can take place at any route while a check is dropped on a desk, passed on to account department, and then sitting for days while waiting to be processed, deposited, and (hopefully) shredded.

Personal checks also contain a variety of information that could jeopardize the security and privacy of an individual. Frank Abagnale, the former criminal, check forger turned FBI consultant, points out a few problems.

“I personally write very few checks. Here’s the reason: if I write a check at Walgreens or CVS, I’m leaving that behind with the clerk. And on that has my name, address, phone number, my bank’s name, and address, my bank account number, routing number, and my signature. And if that store clerk writes down my driver’s license on the front of the check, in nine states—including the one I live in—that’s my Social Security number, too. Then, next to it he writes my date of birth.”

Superior methods are available

With today’s technology, signing up with an online ACH solution is a very simple process. It is a cheaper alternative, and the funds can be quickly deposited into your account. Providing the capability for your members to do PIN/DEBIT transaction to transfer funds is another option as well. If push comes to shove and getting rid of the paper check is not a viable option, there are electronic check processors that can verify, authorize, and capture funds allowing your staff to shred checks immediately.

The faster your organization can provide these options through a secure payment gateway, the more quickly you can mitigate risk, save money, and streamline an archaic payment process. If you would like to know more about how safe and secure accepting payments can be for your non-profit organization, please contact us for a demo.

See Other Strategies

Finally, a Donation Platform with

Donor Paid Fees

Functional Donation Data

Next Day Funding

We innovate together

Our clients' suggestions help us develop products that best serve their business needs.

Providing continual technology releases and new initiatives gives our customers a competitive advantage.

Copyright 2023 Generosity LLC.

Generosity LLC is a registered Independent Sales Organization of Wells Fargo Bank, N.A., Concord, CA.